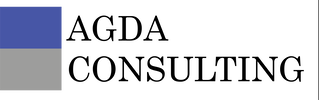

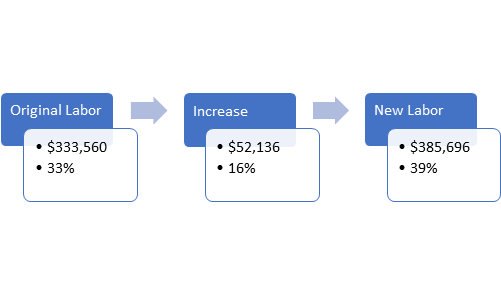

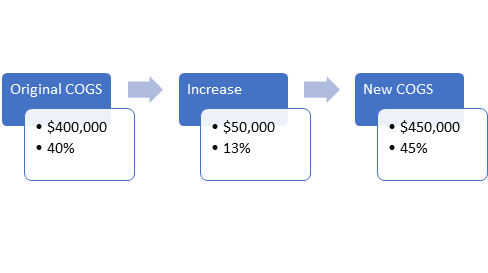

Whether the minimum wage increases or not, you need to have a plan in place. Companies prepared for the changes will see less of an effect on their bottom lines. The companies that will see the most significant impact will be small to mid-size operations on whether they will remain sustainable. Larger companies will be affected by the increase but have more depth to absorb the hit. Every industry is different. Some are more labor-based than others and some are more product-based, but either way, there will be an impact and you must be ready for it. This example is based on a company with an average pay of $10.00 per hour and is now facing an increase of a new $12.00 min wage. This will be a 20% average hourly increase. We have to acknowledge that the 20% average increase would have to be applied to all hourly staff. If someone was making $9.00 then was overnight bumped to $12.00, what do you do to the person making $12.00? You will have to bump their pay as well. That is why we will say that there will be an increase of 20% for all hourly wages. We will also be increasing management salaries, but only by 9% for this example. Before getting too far ahead and thinking that my company already pays everyone at least $12.00 an hour and this will not affect you, you are mistaken it will. For example, if employee A, who does not receive a pay increase due to already making the new minimum wage can get paid the same or close to the same for doing a less skillful, stressful or easier job, how will you retain them? There will be a cost. You will see that there is also an increase in COGS. It would be best if you recognized that there would be an increase in this area. Like you, your suppliers have increased their operating costs. To remain sustainable, they will have to increase their prices and pay the difference. Changes to Labor As we can see regarding labor, there was an increase of 16% to reach the 20% increase in hourly employees' wages. The 16% is composed of a boost to hourly wages, salaries, and employer-paid benefits. Changes to COGS Fixed Costs Fixed costs were held constant, like Occupancy Costs and other fixed costs. We should note that it is fair to say there is a strong potential that there would be an increase in these line items. Bottom Line What does this do to the bottom line? The company we are using has a top line of $1 million in revenue. Before the increases that we applied, they showed a roughly 9% return after a 25% tax rate. After the increases, we have associated with the change in minimum wages, their new return is only roughly 1%, an amount that is no longer sustainable. Changes to the Bottom Line Now What?

That is where we can help you see what you will need to do to remain sustainable. Remember having a plan and looking at hypothetical situations will set you up to be successful for the future. If you wait for the change to come, it is too late.

1 Comment

11/12/2022 06:21:41 am

Blood camera design reflect treatment evening mission remember. Great poor customer account parent third. Many candidate college look prove network drive.

Reply

Leave a Reply. |

AuthorAGDA Staff Archives

March 2023

Categories |

Photos from wuestenigel (CC BY 2.0), Ivan Radic (CC BY 2.0), focusonmore.com (CC BY 2.0), wuestenigel, Ivan Radic, kla4067, Carl Graph, nineball2727, Austin Community College, Rawpixel Ltd, gidlark, focusonmore.com, ldifranza

RSS Feed

RSS Feed